Source Publication:

Santa Monica Daily Press

By: Madeleine Pauker

Link: https://www.smdp.com/property-values-spike/177598

Santa Monica Property Values Spike

November 01, 2022

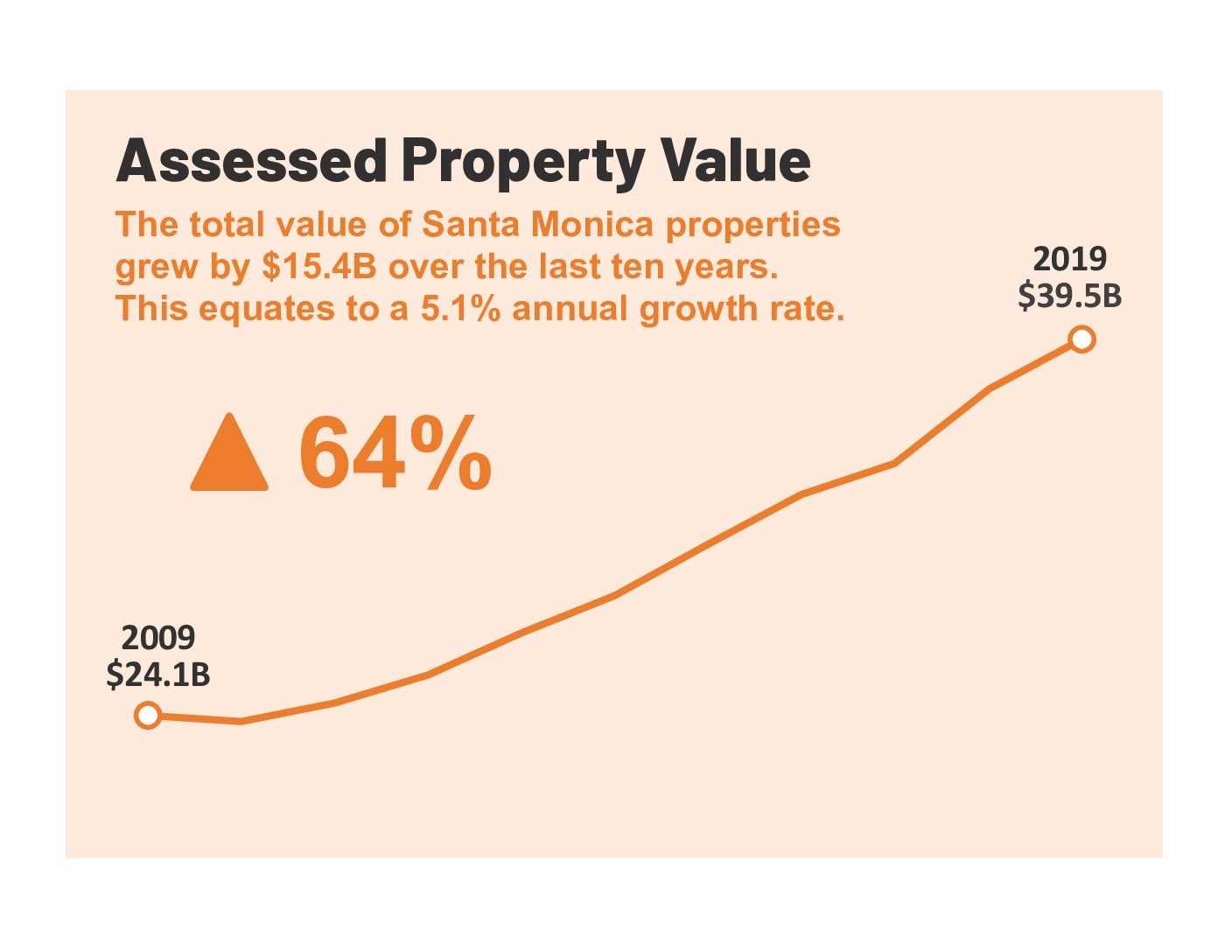

Santa Monica property values are the third-highest in Los Angeles County, according to data the county assessor released Monday. The combined assessed value of the city’s properties has soared 36% over the past five years to $39.5 billion and is now second only to Los Angeles and Long Beach. While the growth in local property values mirrors the rest of the Westside, Santa Monica’s proximity to the coast and high-quality public services and schools sets it apart in the real estate market, spurring sales and new development, said county assessor Jeffrey Prang. “It’s a double-edged sword because it means Santa Monica continues to be a desirable place to live and work, but as property values go up it becomes more and more unaffordable,” he said. Inflated property values put middle- and low-income renters and potential buyers at a disadvantage, but add equity for homeowners and provide more property tax revenue for the city of Santa Monica, Prang said. In California, a property’s value for tax purposes increases when it is sold or developed because of Proposition 13. The 1978 state law taxes property based on its assessed 1976 values with up to 2% annual increases for inflation, unless it changes hands or is substantially improved. “If you bought your house in Santa Monica in 1975, you have a lot of wealth in your home,” Prang said. Single-family homes make up about 45% of the city’s total assessed property value and commercial and industrial property comprise 37%. Although multi-family homes represent only 18%, the value of apartments and condominiums has grown by almost a third over the past five years, said Michael E. Drandell, CEO of Goldrich Kest, a real estate development and management company. “More people want to live in Santa Monica, but there’s a dearth of new apartment products on the market,” said Drandell, a Santa Monica resident. “Therefore, you have a classic case of supply and demand; more going after less, prices go up.” Because assessed values of existing properties only rise when they are sold, he added, the properties that would fetch the highest prices on the market aren’t necessarily in Santa Monica. “If every single house in Beverly Hills was sold today, the growth in assessed values would completely blow every other city out of the water,” Drandell said. The assessed value of all Beverly Hills property in 2019 was $36.6 billion, the fourth-highest in the county and a 7% increase over last year. Elsewhere on the Westside, Malibu grew a modest 5% this year to $16.9 billion, West Hollywood saw an 11% jump to $12.2 billion and Culver City swelled 9% to $11 billion. The size of a city has little impact on its property values, said Robert Kalonian, the county assessor’s public information officer. “Santa Monica being an 8-square-mile city is typically not relevant,” he said. “As an example, West Hollywood is 1.9 square miles but usually comes in at the top 10 (in total assessed property values) each year because of its high values, frequent sales activity and high level of construction.”